So, you’ve decided to dive into the thrilling world of purchasing an accounting practice; a decision that will have you drowning in financial statements and reveling in the company of number-crunching professionals. Before you grab your abacus and sign on the dotted line, there are some crucial factors to consider that’ll ensure this investment doesn’t turn into a never-ending game of “hide-and-seek” with your money.

Don’t worry, we’ve got your back (and your balance sheets)! We’re here to provide you with a crash course in assessing potential accounting practices like a pro. From evaluating client bases to understanding office culture, we’ll guide you through this exhilarating journey so that when it’s time for negotiations, you’re armed with all the knowledge needed to make an informed decision. Just remember: There’s no such thing as too much due diligence when it comes to protecting your assets – and sanity!

Assess the Financial Health of the Practice

Now, let’s dive into evaluating the financial well-being of the firm you’re interested in acquiring – this is crucial for ensuring your investment pays off. You don’t want to end up with a lemon of an accounting practice, do you? Think of it like dating: you wouldn’t commit to someone without doing a little snooping on their social media pages first, right? Well, financial analysis is just like that, but with more spreadsheets and less stalking. Start by conducting a thorough profitability assessment of the business – look at its income statement, balance sheet, and cash flow statement. Like a detective examining their suspect’s alibi (or a hopeless romantic scouring their crush’s Instagram), leave no stone unturned.

As you dissect the financials like a pro surgeon (scalpel not required), keep an eye out for any red flags or warning signs that could hint at future problems. Are there any trends that make you furrow your brow in concern? Is the firm heavily reliant on one big client for its revenue? Does it have enough working capital to pay off its debts and continue operating smoothly? Remember: knowledge is power when it comes to making smart investments! So channel your inner Sherlock Holmes and dig deep into those numbers – after all, who needs elementary school math skills when you’ve got advanced forensic accounting techniques?

With your newfound understanding of the practice’s fiscal fitness (or lack thereof), you’ll be better equipped to make an informed decision about whether or not this particular acquisition is worth pursuing. More importantly, though, let’s not forget about our clients – they’re the lifeblood of any successful accounting practice! As we move forward in our quest for acquisition excellence, it’s time to evaluate another essential aspect: the client base. So grab your magnifying glass and deerstalker hat as we delve into yet another intriguing element of buying an accounting practice.

Evaluate the Client Base

Take a good look at the client base, as it’s crucial to know who you’ll be working with and if they align with your goals. You wouldn’t want to invest in an accounting practice full of clients who are still using abacuses and parchment paper, would you? Evaluate the client demographics, such as their industries, business sizes, locations, and any other factors that might matter to you. It’s like dating – you want to make sure there’s compatibility before committing!

Now, let’s talk about technology adoption. As much as we love reminiscing about the good old days of filing cabinets and fax machines (said no one ever), being up-to-date with technology is vital in today’s fast-paced world. Check if the clients are tech-savvy or stuck in a technological time warp. Ask yourself: Are they using cloud-based accounting software? Do they embrace digital communication methods? Will they adapt to new tools that can improve efficiency? Remember: If your clients are living in the 21st century while your practice is stuck in 1999, it will be harder than teaching your grandma how to use emojis.

So now that you’ve done some serious sleuthing on the client base and made sure there won’t be any major mismatches or awkward first dates (I mean meetings), it’s time for another important aspect to consider – staffing! Before diving headfirst into this new adventure, take a moment to analyze the current team behind those beautiful balance sheets and tax returns. Don’t worry; we’re not asking for fingerprints or background checks here – just an understanding of whether they have what it takes to help you achieve success together. Up next: analyzing the staffing situation!

Analyze the Staffing Situation

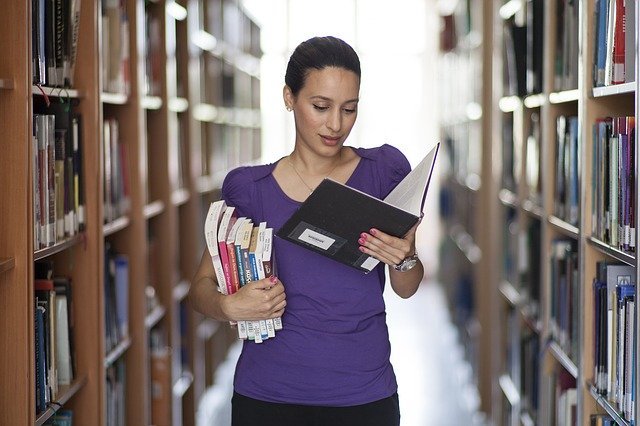

You might think it’s all about the numbers, but don’t underestimate the importance of assessing the staffing situation in your potential new business venture. After all, who wants to inherit a team that rivals the cast of “The Office” in terms of dysfunction and thwarted ambition? Staffing challenges can be as tricky as untangling last year’s holiday lights, so you’ll want to take a good hard look at who you’re bringing on board – not just for their skills and experience, but also for their ability to play well with others. Remember, employee retention is like a delicate soufflé: one wrong ingredient can cause the whole thing to collapse.

Now that we’ve got your attention with culinary metaphors (who doesn’t love soufflé?), let’s dive into some specifics. If possible, arrange meet-and-greets with key staff members before making any commitments; this will give you an opportunity to gauge their enthusiasm for their work and assess whether they’re likely to stick around post-acquisition. Keep an eye out for red flags such as chronic lateness or a penchant for water cooler gossip – these workplace sins are small potatoes individually but can add up to a heaping plate of discontent if left unchecked. Also consider whether there might be opportunities to improve efficiency through restructuring or technological upgrades; after all, sometimes less is more when it comes to staffing.

As important as evaluating individual employees may be, don’t forget that every successful accounting practice is more than just the sum of its parts – it’s also about how well those parts fit together into a harmonious whole. In other words: culture matters! Pay attention not only to industry-specific knowledge and skill sets but also interpersonal dynamics and overall office vibe. You’ll want your newly acquired team humming along like a well-oiled machine rather than bickering over who stole whose stapler (we’re looking at you again, “The Office”). So now that you’ve got the inside scoop on staffing, it’s time to delve into understanding the practice’s culture and reputation. Trust us, you’ll want to know what makes this place tick before you sign on the dotted line.

Understand the Practice’s Culture and Reputation

Diving into the culture and reputation of your potential new business is essential, as it’ll help you grasp what truly makes this place unique and if it’s a good fit for your vision. You may have heard that old saying, “you can’t judge a book by its cover.” Well, in the world of accounting practices, you also can’t judge an office by its practice valuation alone. Sure, numbers are important (duh, we’re talking about accounting here), but there’s more to consider than just dollar signs.

Think about cultural fit because let’s face it: no one wants to be stuck with an office full of disgruntled accountants who secretly despise their jobs – or worse yet, each other! So take some time to dig deeper into the firm’s inner workings before making any hasty decisions. Chat with the staff members over a cup of coffee (or three) and try to understand their perspective on how things operate within the company. Do they enjoy working there? Are they proud of their firm’s reputation? And most importantly: does everyone laugh at your jokes?

Now that you’ve got a feel for the practice’s vibe and reputation in town (hopefully without too many awkward encounters), it’s time to weigh these intangible factors against cold hard facts like location and facilities. While cultural assessments might not show up in spreadsheets or financial reports, trust us when we say that understanding what lies beneath those impressive figures will play an enormous role in your decision-making process. After all, buying an accounting practice isn’t just about crunching numbers; it’s also about creating harmony among people who crunch numbers together! So buckle up and prepare for our next stop on this thrilling ride: considering the location and facilities of your potential new venture.

Consider the Location and Facilities

Imagine yourself stepping into the perfect location, surrounded by state-of-the-art facilities that just scream success – that’s what you’re aiming for in your search, right? Well, it’s not all about the glitz and glamour; there are some practical factors to consider as well when looking at the location and facilities of an accounting practice. You want to ensure that this shiny new office doesn’t end up being a pretty facade hiding a sinking ship.

- Location advantages: What benefits does the location provide? Is it conveniently accessible for clients or nestled in an area with plenty of potential customers? Consider things like parking availability, proximity to public transportation, and nearby amenities (like coffee shops – because let’s face it: accountants run on caffeine).

- Facility upgrades: Sure, having a swanky office is fantastic, but don’t forget to check into any necessary facility upgrades or maintenance. The last thing you want is to inherit a leaky roof or crumbling infrastructure – unless you’re looking for an excuse to step away from spreadsheets and try your hand at DIY construction.

- Room for growth: Does the current space allow room for expansion if your client base grows rapidly? It might be tempting to buy a smaller space now and plan on upgrading later, but you could save yourself time and stress by considering future needs during your initial search.

It’s crucial not only to think about how fabulous your new accounting practice will look on Instagram but also evaluate the practicalities behind its appealing exterior. Taking these factors into account can help ensure long-term success in your investment (and make tax season feel like less of a headache). Now that we’ve covered real estate basics let’s move on – next up: planning for transition and integration!

Plan for Transition and Integration

So, you’ve found the perfect accounting practice to buy – congrats! Now it’s time to develop a smooth transition plan and integrate that shiny new practice into your existing business like peanut butter and jelly. Buckle up, because we’re about to dive into the wonderful world of merging businesses with grace, style, and just a touch of humor.

Developing a Transition Plan

Envision yourself crafting a seamless transition plan, paving the way for you to step confidently into your new role as the owner of an established bookkeeping business. This isn’t just any ol’ transition plan; it’s a work of art with all the grace and finesse of a master calligrapher. You’ve got your transition timeline mapped out like an expert cartographer, from day one when you receive the keys to your shiny new office, right up to day 100 when you’re sitting in your swanky ergonomic chair with a steaming cup of artisanal coffee feeling like king (or queen) of the accounting world! And let’s not forget about technology adaptation – because nothing says “I’m ready for this” quite like seamlessly integrating that fancy new software with all its bells and whistles.

As you bask in the glow of your perfectly executed transition plan, it’s time to start thinking about how to integrate this practice into your existing business. After all, you wouldn’t want to end up feeling like Dr. Frankenstein who created a monster by merging two entities that just don’t mesh well together. So grab that lab coat and get ready to dive deep into creating synergy between these businesses while keeping an eye on both short-term success and long-term growth – because honey, this is where it gets really exciting!

Integrating the Practice into Your Existing Business

Now that you’ve aced your transition plan, it’s time to focus on weaving this new bookkeeping practice seamlessly into the fabric of your existing business, ensuring a harmonious and prosperous union. Merging software systems and streamlining processes are two critical components of integration that, when done correctly, will have you feeling like a maestro conducting an orchestra of perfectly in-sync financial professionals.

But bear in mind, dear reader: integrating an accounting practice is not all rainbows and unicorns. The path to successful integration can be fraught with challenges; however, let us remind ourselves of the ultimate goal here – creating a thriving business symphony! To help you stay on track during this process, we present you with three sub-lists designed to evoke an emotional response:

- Triumphs:

- Successfully merging software systems

- Streamlined processes humming along beautifully

- Delighted clients singing your praises

- Tribulations:

- Confronting unexpected hiccups

- Navigating employee resistance to change

- Managing inevitable growing pains

- Tender moments:

- Witnessing newfound camaraderie among team members

- Reaching milestones that seemed impossible at first glance

- Realizing just how far your newly-expanded empire has come

Remember: the road may be long and winding (and perhaps filled with a few potholes), but by staying focused on the task at hand and keeping these emotional touchstones in mind, you’ll emerge victorious – having successfully integrated your newly-acquired accounting practice into your existing business like a true maestro. Bravo!

Conclusion

So, you’re ready to take the plunge and buy that accounting practice, eh? Just remember that Rome wasn’t built in a day – or by one person. Your new empire will require careful consideration of its finances, clients, staff, culture, locale, and transition plans.

As you set sail on this thrilling voyage to accounting practice ownership, keep your wits about you and don’t lose sight of the treasure map. With humor and intelligence guiding your way, you’ll soon be basking in the sweet success of your new kingdom!

0